While COVID sucks, it hasn’t been a drag on everything. In fact, the pandemic has been excellent for the cannabis industry. These details and more are in a newly released report, titled, ‘The State of the Cannabis Industry 2020; Cannabis, COVID-19, and Beyond’.

The report, a compilation of efforts by Vangst, Flowhub, and Leaflink, covered the cannabis industry during three distinct phases of the pandemic — Pre-COVID, COVID response, and COVID reality. Each company brought its unique industry perspective to the report; Vangst provided insight on the employment situation, Flowhub detailed the effects on the dispensary side, and Leaflink from the wholesale part of the equation.

Let’s look at the most interesting tidbits from the three phases of the pandemic (thus far):w

Pre-COVID, January 1 – February 29

- Consumers kept to their usual product preferences in 2020, but COVID changed how and when customers buy cannabis. Think bulk buying.

- States with a delivery retail model in place did well.

- States where cannabis was deemed “essential” did well.

- Cartridges were very popular.

- Sales of flower were strong, comprising 28% of orders compared to 21% of orders in 2019.

- Surprisingly, in a period of time where many folks were eating their feelings, sales of edibles didn’t see much of an increase.

COVID Response, March 13 – March 27

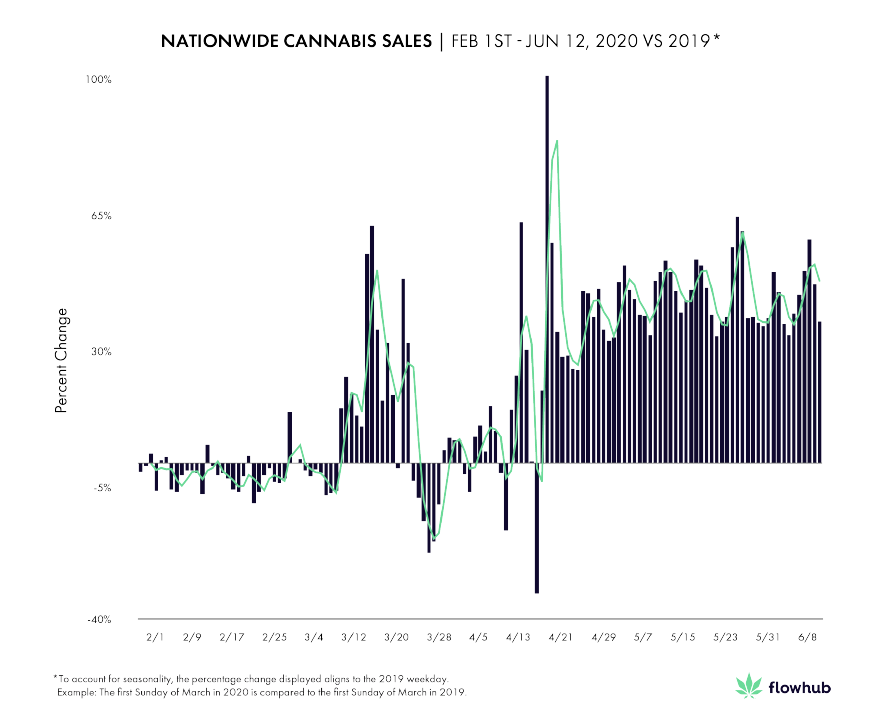

- Sales spiked for two weeks as stay at home orders kicked off.

- Flowhub reported cannabis sales in Denver were 140% higher on March 23 than on any other Monday in 2020.

- States with legal cannabis saw a 36% uptick in orders before they dropped off. Sales surged again when “essential” status was gained.

- The average order value went up 30% the week of March 16.

COVID Reality, March 30 – Present

- The typically social 4/20 holiday was a bust.

- Medical marijuana retailers weren’t really affected.

- Consumers spent on average $69.37 per retail “basket”, compared to a basket average of $62.11 in 2019. In Colorado, numbers were higher, with average retail “baskets” of $73.13.

- 40% of Vangst respondents reported their projected revenue remains unchanged, and a third of the group reported revenue increases.

As measured by Leaflink’s Gross Merchandise Value (GMV), 2020 year to date sales surpassed 2019 levels, and if trends continue, cannabis may be well ahead of 2020 forecasts. Alaska’s sales are up 11% overall, Colorado’s sales are up 25%, California sales are up 70% and Oregon’s sales are up a whopping 74%.

The current climate has emphasized the importance of three things: eCommerce, store layouts, and meeting consumer demand. Those that get all three just right will remain competitive and thrive, setting the stage for a new era of the cannabis industry while able to withstand societal turmoil.