Talk about flower power. Since COVID officially became a thing, there’s been unrelenting, unprecedented demand for cannabis flower in California, Colorado, Nevada and Washington. The corresponding retail prices for flower have jumped too.

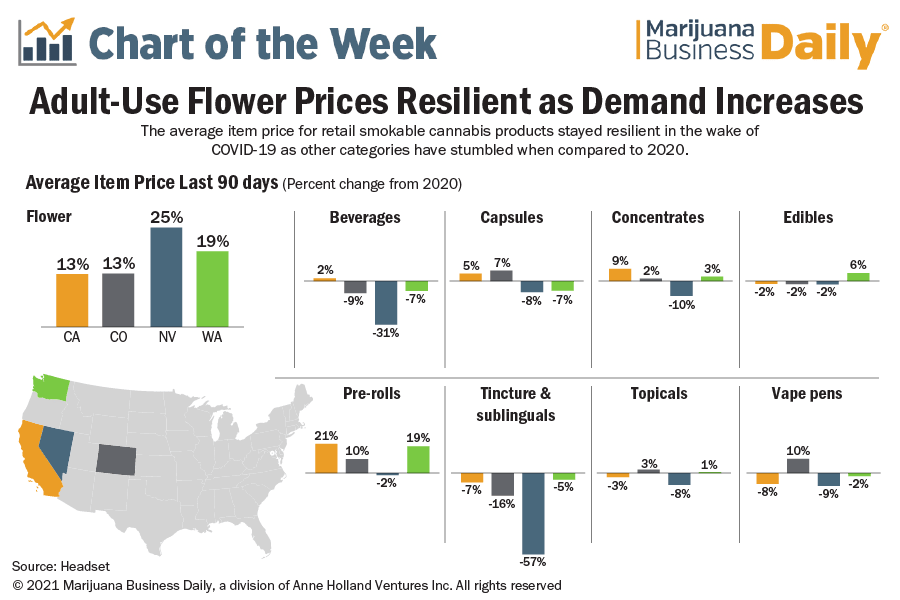

Retail data provided by Headset, a cannabis analytics company in Seattle, revealed that retail flower prices in those four Western states grew by 17% combined. The price of pre-rolls went up by 15%. Headset’s data tracked the retail prices from the past 90 days as compared to the same period the prior year. Specifically, retail prices on flower per state increased by the following percentages:

- California, 13%

- Colorado, 13%

- Nevada, 25%

- Washington, 19%

Interestingly enough, the prices for other product categories — edibles, tinctures, topicals, vapes, and concentrates had a very slight increase or a price decrease. In Nevada, for example, every other product category tracked by Headset showed a price decrease. Flower was the only cannabis product category that had a retail price increase.

This is music to the ears of cannabis retailers. Increased demand means increases in price. It might benefit retailers in other ways, too; if more customers dip their toe into the canna-waters, they’re more apt to try other products and compare the effects to those of flower.

California’s retail prices were fairly split, with the largest increase in flower. Beverages, capsules, concentrates and pre-rolls had a very small increase, but edibles, tinctures/sublinguals, topicals and vapes showed a price decrease.

In Colorado, wholesale flower hit 2016-level prices. The average per-pound rate for flower in that state increased by a whopping 31% from October 2020 to the end of January 2021.

Nevada’s tourism tanked thanks to the pandemic, but cannabis sales are steady, even if other product categories saw a drop. The state is unique, with tourists drawn to a different (dare I say intense) sort of product mix while on vacay? The increase in flower and the decrease in all other categories is a great indicator of what different demographics seek out as it relates to cannabis and cannabis-based products.

While some of the increase in flower’s retail price can be attributed to cannabis-legal states categorizing the industry as ‘essential’ throughout, it doesn’t paint the whole picture where the pandemic is concerned. While the combined medical and rec markets only grew by 7% (through September 2020), there were 32% more sales in September 2020 when compared to September 2019. Most states with legal cannabis saw double-digit sales growth during the crazy year known as 2020.